Return on investment was _____. When calculating Return on Investment current assets include.

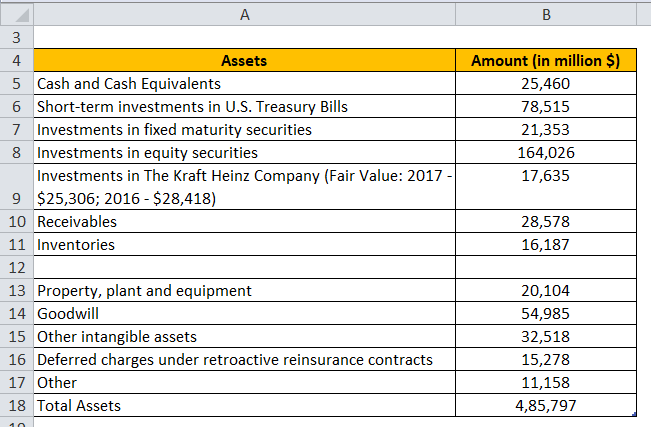

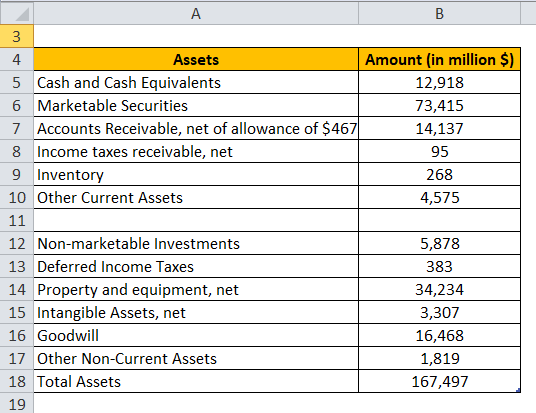

Current Assets Formula Calculator Excel Template

Gain from Investment - Cost of Investment.

. There are two ways to calculate ROA. The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio.

Investment gain Net Income Cost of Investment Total Assets X. Cash Accounts Receivable and Inventory. N Number of years investment is held beginalignedtextAnnualized ROI big 1 textROI 1n -.

ROI Net Profit Total Investment 100. Keep in mind that if you have a net loss on your investment the ROI will be negative. The basic formula for ROI is.

Return on Net Operating Assets NI Net Operating Assets. Cash Accounts Receivable and Equipment O d. Buildings and Real Estate O b.

Using ROA to compare performance between companies. Calculate return on equity for 2020 and 2019. Net Income Average Assets in a Period of Time Return on Assets.

The Return On Assets Calculator can calculate the return on assets ratio of any company if you enter in the net income and the total assets of the company. Total assets working capital stockholders equity or initial cash outlay. Net Profit Margin x Asset Turnover Return on Assets.

100000 500000 02 or 2 percent. Macey Incs investment center had invested assets at the beginning of the year of 300000. Return on assets indicates the amount of money earned per dollar of assets.

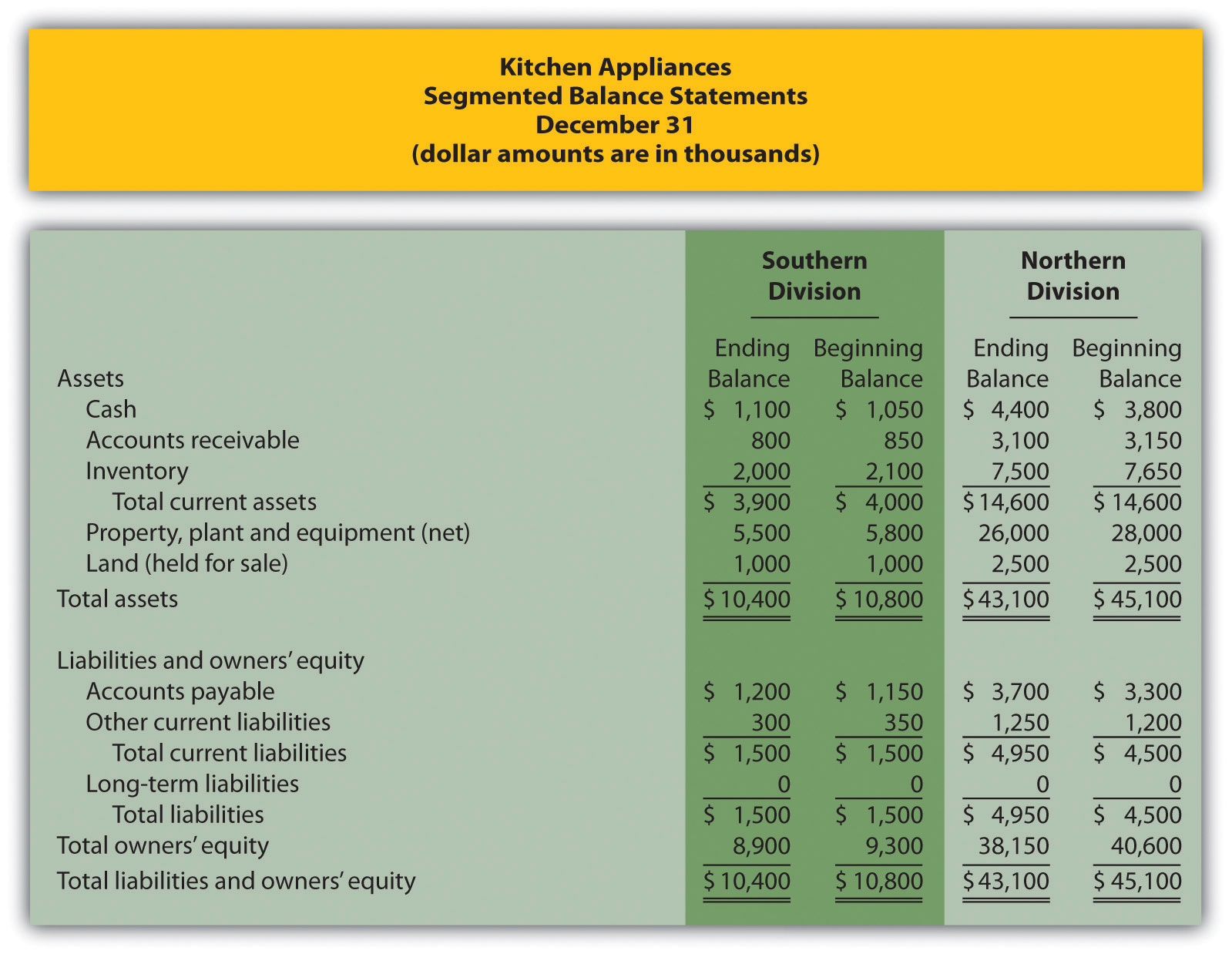

It is most helpful to use the return on assets ratio as a. Calculate the ratio as follows. The current ratio is computed by dividing current assets by current liabilities.

However it is important to note that the result of the calculation indicates the efficiency of assets to generate a return not how much shareholders are making on their investment. The second method is simpler and we will focus on it here. The RNOA figure provides useful insights into a companys ability to generate profits from equity resources.

Using ROA to determine profitability and efficiency. The average assets are worth 500000. This calculation will include current liabilities plus long-term debt.

ROOA Net Income Total Assets Assets Not in Use. Using ROA to determine asset-intensiveasset-light companies. Your company is ready to make a big purchase a fleet of cars a piece of manufacturing equipment a new.

There are two separate methods you can use to calculate return on assets. Simply put your current assets are all of your assets added together. Ending invested assets totaled 400000.

Calculating Invested Capital. ROI Investment Gain Investment Base. From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000.

Some calculations divide net income by total assets instead of equity. The Most Common Mistake People Make In Calculating ROI. Return On Assets Definition.

A companys economic resources that it expects will provide. To help put current assets and current liabilities well use Home Depot as an example. The basic formula for calculating the ROI of an investment is to subtract the cost of the investment from the revenues that investment will generate and divide it by the cost of the investment to obtain a percentage.

Shareholders can evaluate the ROI of their stock holding by using this formula. It distinguishes the financial and investment income from the operating income. Profit is not the same as cash.

Return on Assets for Companies. What is a good ROI ratio. Assets liabilitiesowners equity.

This variation can also be very useful to shareholders and creditors. To calculate the denominator of the ROIC equation you need access to both the firms balance sheet and statement of cash flows. Your business should have a minimum current ratio of 10.

ROI Net Income Current Value - Original Value Original Value 100. When calculating Return on Investment current assets include. The first method is to divide the companys net income by its total average assets.

If possible the average amount for the period is used. Calculate return on investment based on net income and average total assets for 2020 and 2019. The balance sheet shows subtotals for assets liabilities and owners equity in related groupings.

As a most basic example Bob wants to calculate the ROI on his sheep farming operation. Like net working capital the current ratio assesses a businesss liquidity. For example a company has a net income of 100000.

Calculate the return on investment ROI of an investment center which had operating income of 500000 and operating assets of 2500000. The basic formula for ROI is. Calculate the total amount of the firms debt.

The second method is to multiply the companys net profit margin by its asset turnover rate. Calculate earnings per share for 2020 and 2019. Annualized ROI 1 ROI 1 n 1 100 where.

Hence Return on Net Operating Assets 02363 or 2363. Total revenue for the year was 1050000 and net operating income was 70000. The return on investment ratio is also called the return on assets ratio because that investment refers to the firms investment in its assets.

The return on assets ROA ratio is a handy way to measure the profitability of a business based on a relation to their total amount of assets. A current ratio of less than 10 indicates low liquidity and poor financial health. Return on assets calculation methods.

You calculate the ROOA by subtracting the value of the assets not in use from the value of the total assets and then dividing the net income by the result. Equipment and Real Estate O c. Balance sheet and statement of cash flows.

Similarly to calculate your current liabilities you add all debts and obligations together such as your accounts payables wages payable and short-term debt. Calculate working capital and the current ratio for each of the past three years.

Using Return On Investment Roi To Evaluate Performance Accounting For Managers

Net Current Asset Value Per Share Ncavps A Method To Value Stocks Getmoneyrich

Current Assets Formula Calculator Excel Template

Current Assets Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

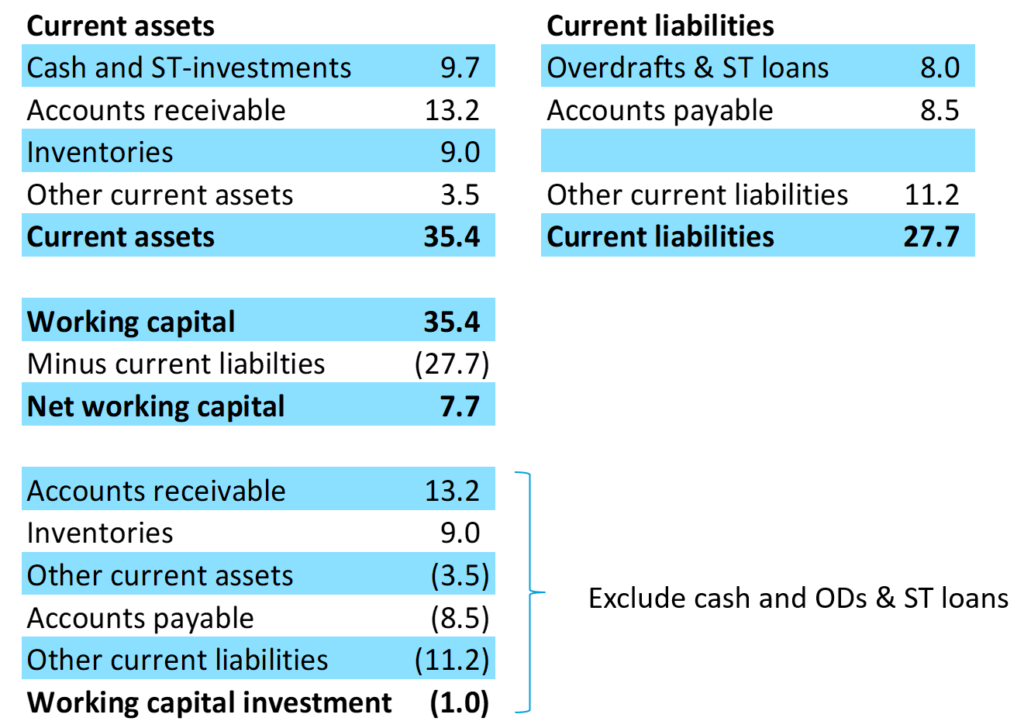

Underestimating Working Capital Investment

Calculate Financial Strength Ratios Online Investing Hacks Book

0 Comments